AUGUST, 2025 — The COBA 2025 Conference once again proved to be the premier gathering for Australia’s customer-owned banking sector. Across three days, industry leaders, technology providers, and cooperative banking professionals came together to explore the challenges and opportunities of an industry undergoing rapid digital transformation. From inspiring keynote sessions to interactive panel discussions, the event highlighted how credit unions and mutual banks are embracing innovation to strengthen resilience, improve customer experience, and deliver secure services.

V-Key was proud to be part of COBA 2025, showcasing V-Key ID at our booth through a series of engaging demos. Beyond passwordless authentication, V-Key ID provides a secure and privacy-preserving digital identity that is portable across apps, devices, and ecosystems. Built on advanced cryptographic technology, it allows financial institutions to protect customers, meet compliance obligations, and enable a new standard of trusted digital engagement.

Danny Lam demonstrating V-Key ID’s seamless passwordless authentication with face biometrics.

Nathan Curcio, Sales Manager, explaining V-Key ID to delegates at the booth

Our presence at COBA 2025 delivered several clear outcomes:

- High-quality engagement: We had a strong number of meaningful conversations with decision-makers eager to strengthen their digital identity strategies.

- Positive partner ecosystem: Many partners recognised the opportunity to collaborate with V-Key, affirming the value our solutions bring to regulated industries.

- Market differentiation: Delegates consistently noted that V-Key ID stood out as a distinctive, future-ready solution.

- Proven reliability: V-Key ID’s demos performed seamlessly throughout COBA 2025, reinforcing market confidence in the technology’s maturity and readiness for large-scale adoption

|

|

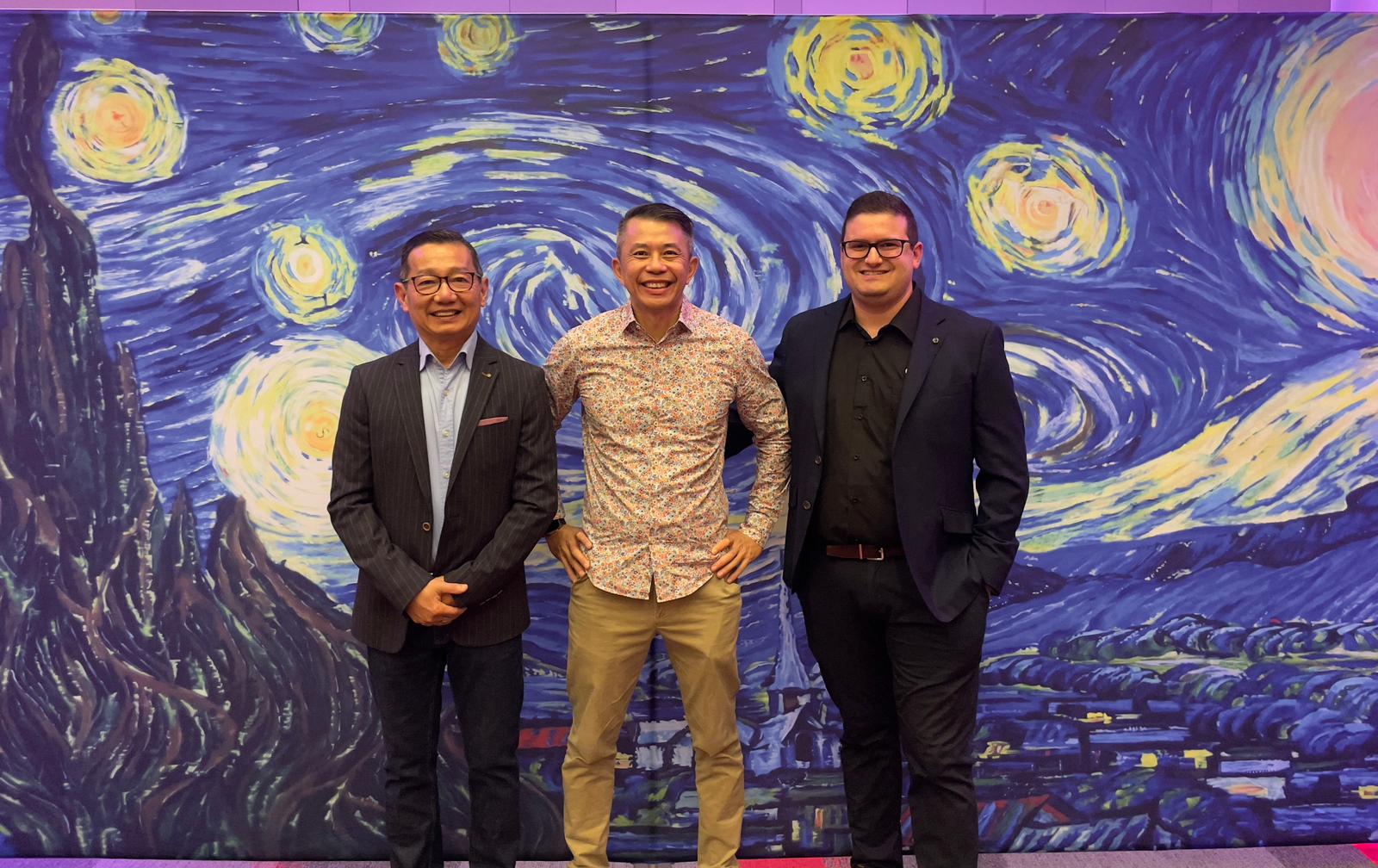

Left: V-Key Australia team members Danny and Nathan with Peter Mah, SVP for Global Business, ahead of the conference dinner. Right: Delegates gathered for the COBA 2025 conference dinner programme

Driving Passwordless Adoption in Australia

Australia is at the forefront of adopting passwordless authentication, as financial institutions move to strengthen security while enhancing the user experience. Rising threats from phishing, credential theft, and social engineering highlight the need for stronger safeguards, and V-Key ID addresses this shift by offering a trusted, portable identity that works seamlessly across devices and platforms. By reducing reliance on passwords and streamlining authentication, V-Key empowers financial institutions to protect customers while delivering frictionless digital journeys.

Strengthening Security and Compliance

In parallel with innovation, compliance remains a cornerstone for Australia’s financial sector. Staying aligned with APRA CPS 234 is critical to managing risk and maintaining trust. V-Key ID is designed to meet and exceed these requirements, alongside international standards such as ISO 27001 and SOC 2. Our APRA Compliance Overview provides institutions with a clear roadmap for integrating mobile-first solutions that not only safeguards customer data but also builds organisational resilience.

By aligning security, compliance, and customer experience, V-Key enables financial institutions to innovate confidently in an environment of growing regulatory expectations.

Looking Ahead to COBA 2026

The energy of COBA 2025 sets the stage for an even bigger year ahead. In 2026, COBA will partner with the World Council of Credit Unions to co-host the World Credit Union Conference in Sydney, a landmark gathering expected to attract over 2,300 delegates from 60 countries.

For V-Key, COBA 2025 reaffirmed our position as a trusted partner to Australia’s financial sector. With stronger visibility, growing partner momentum, and the proven impact of solutions like V-Key ID, we are well placed to continue driving innovation, strengthening security, and supporting compliance across the market.