2025 April, Vietnam – V-Key had the privilege of participating in the State Bank of Vietnam (SBV) CIO Roundtable event on 1 April 2025. This event brought together key players in Vietnam’s financial industry to discuss the future of banking security and the impact of regulations on digital transformation. It was an important platform to explore how V-Key supports financial institutions in Vietnam to stay ahead of regulatory compliance and security innovation.

Over the years, Vietnam’s banking regulations have undergone significant transformation to enhance security, compliance, and data protection. These evolving measures are critical as the country strengthens its digital banking infrastructure and addresses the growing cybersecurity risks.

In line with global trends drive stricter security and data privacy regulations, Vietnam’s progressive reflects a strong commitment to aligning with international standards, helping financial institutions prepare for future cybersecurity and data protection.

Here are some of the key regulations that have shaped Vietnam’s banking landscape:

- Circular 35 (2016): Established security requirements for online banking services.

- Circular 09 (2020): Mandated integrity measures for internet banking applications.

- Decree 13 (2023): Introduced comprehensive personal data protection regulations.

- Circular 18 (2018) & Decree 117 (2018): Strengthened transaction data security and IT infrastructure requirements.

- Decision 2345: Implemented security solutions for online and card-based payments.

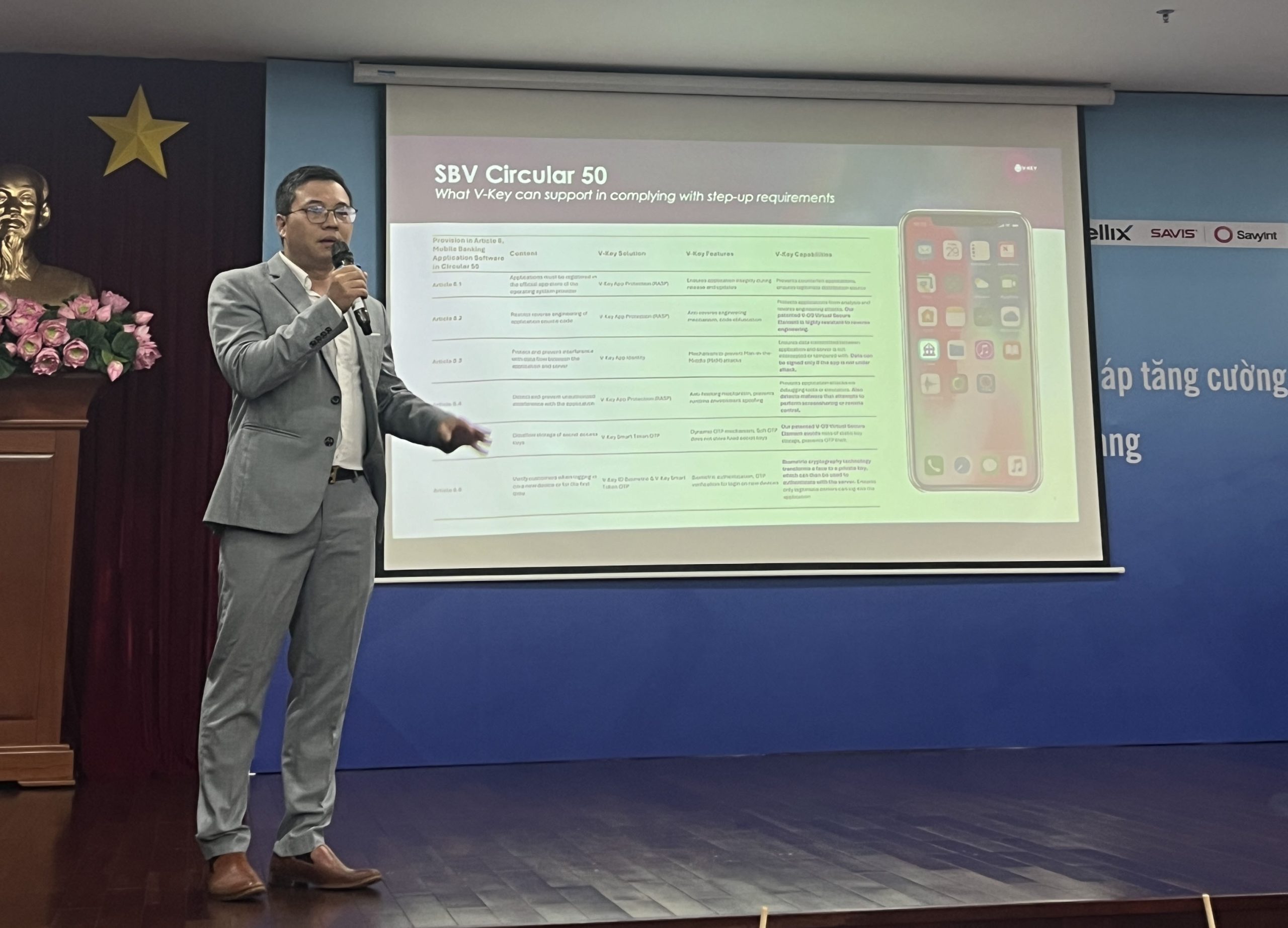

- Circular 50 (2024): The latest mandate on security and safety for online banking services, pushing for stronger digital identity verification and compliance measures.

- Circular 64 (2024): Provides guidance for banks to implement Open APIs, supporting integration with third-party services and improving customer experience.

These regulations underscore Vietnam’s commitment to creating a robust, secure digital banking ecosystem that protects both users and financial institutions.

Ensuring Compliance and Staying Future-Ready

At V-Key, we understand that compliance is not just about meeting regulatory demands but also about being ready for what comes next. With our deep understanding of security and regulatory requirements, we work closely with financial institutions to ensure our solutions stay aligned with both local and global standards.

From SBV’s Circular 50 to the upcoming Circular 64 on Open Banking, V-Key helps financial institutions navigate regulatory requirements with solutions built to support long-term compliance and security.

V-Key ID Setting New Standards for Secure Authentication

One of our key solutions, V-Key ID, is an advanced biometric authentication solution that provides strong protection for digital identities. As compliance regulations become stricter, V-Key ID offers banks and financial institutions a secure, scalable solution that meets the highest standards of data protection.

With increasing regulatory pressure on financial institutions, V-Key ID provides a proactive approach to security by supporting compliance with current regulations while anticipating future challenges.

Key benefits of V-Key ID include:

- Higher performance & accuracy: V-Key ID delivers precise biometric authentication, even in the face of advanced threats like deepfake attacks.

- Stronger protection against advanced threats: With anti-spoofing measures built into the system, V-Key ID is specifically designed to thwart sophisticated fraud attempts.

- FIDO2 compliance: V-Key ID ensures secure passkey storage in V-OS, meeting the latest global authentication standards.

- Passwordless authentication: V-Key ID supports secure password-based authentication, offering an additional layer of flexibility for users who prefer traditional login methods while maintaining high levels of security.

By adopting V-Key ID, financial institutions can not only strengthen their security posture but also maintain compliance with the growing number of regulations governing digital banking. This ensures both user trust and business continuity.

A Collaborative Effort for Secure Digital Transformation

We extend our sincere gratitude to vCyber, our local strategic partner, for their continued support in driving secure digital transformation in Vietnam. We also thank SBV and all the industry leaders who participated in the event and engaged in insightful discussions.

With 55% of our developers based in Vietnam, V-Key is committed to advancing secure digital transformation, both within Vietnam and across global markets. Our local presence enables us to support financial institutions with innovative solutions that address the demands of the regulatory environment.

We look forward to continuing our role in strengthening digital trust across the financial sector.

For more information on how V-Key can help your institution stay ahead of regulatory requirements and strengthen digital identity security, contact us today.